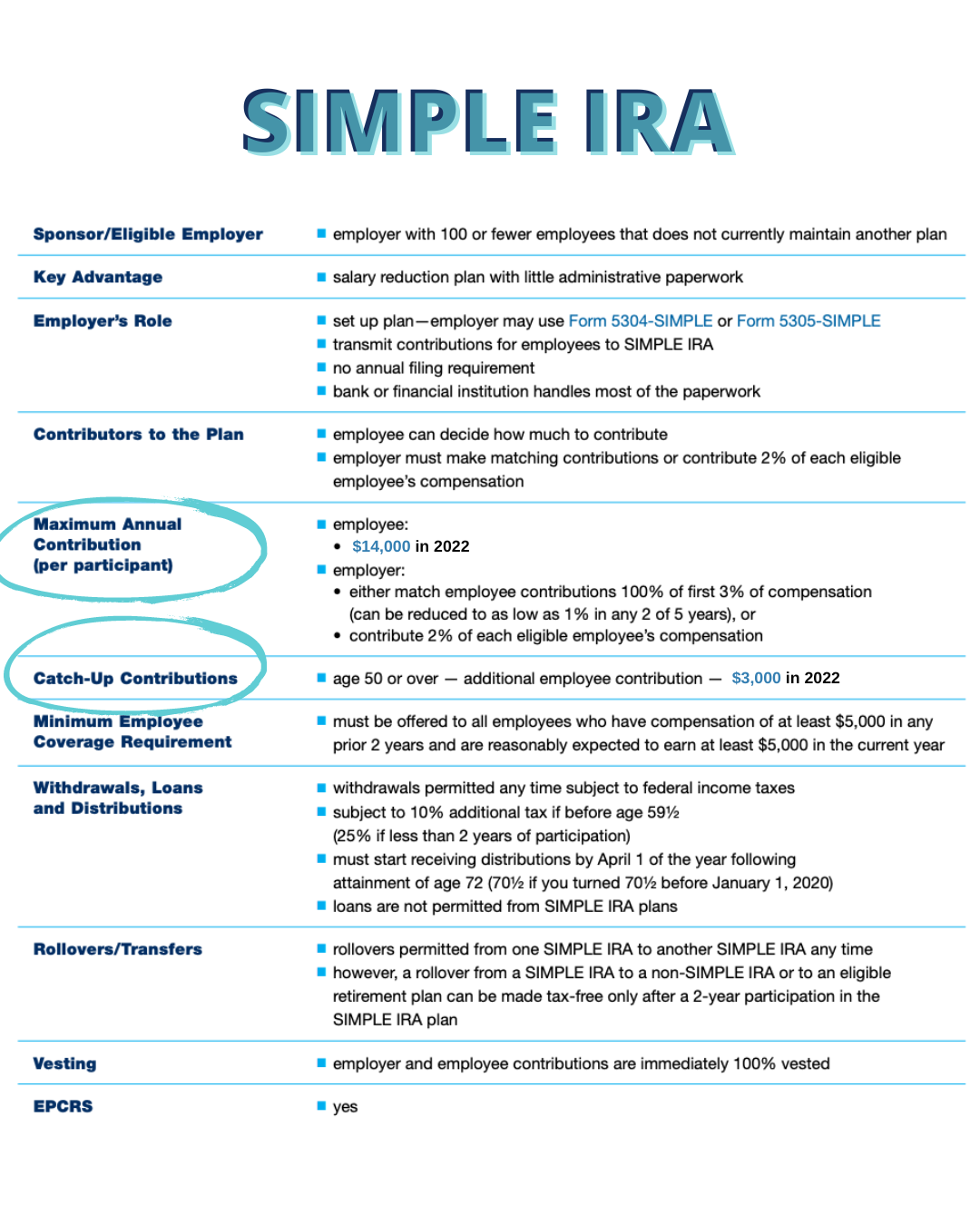

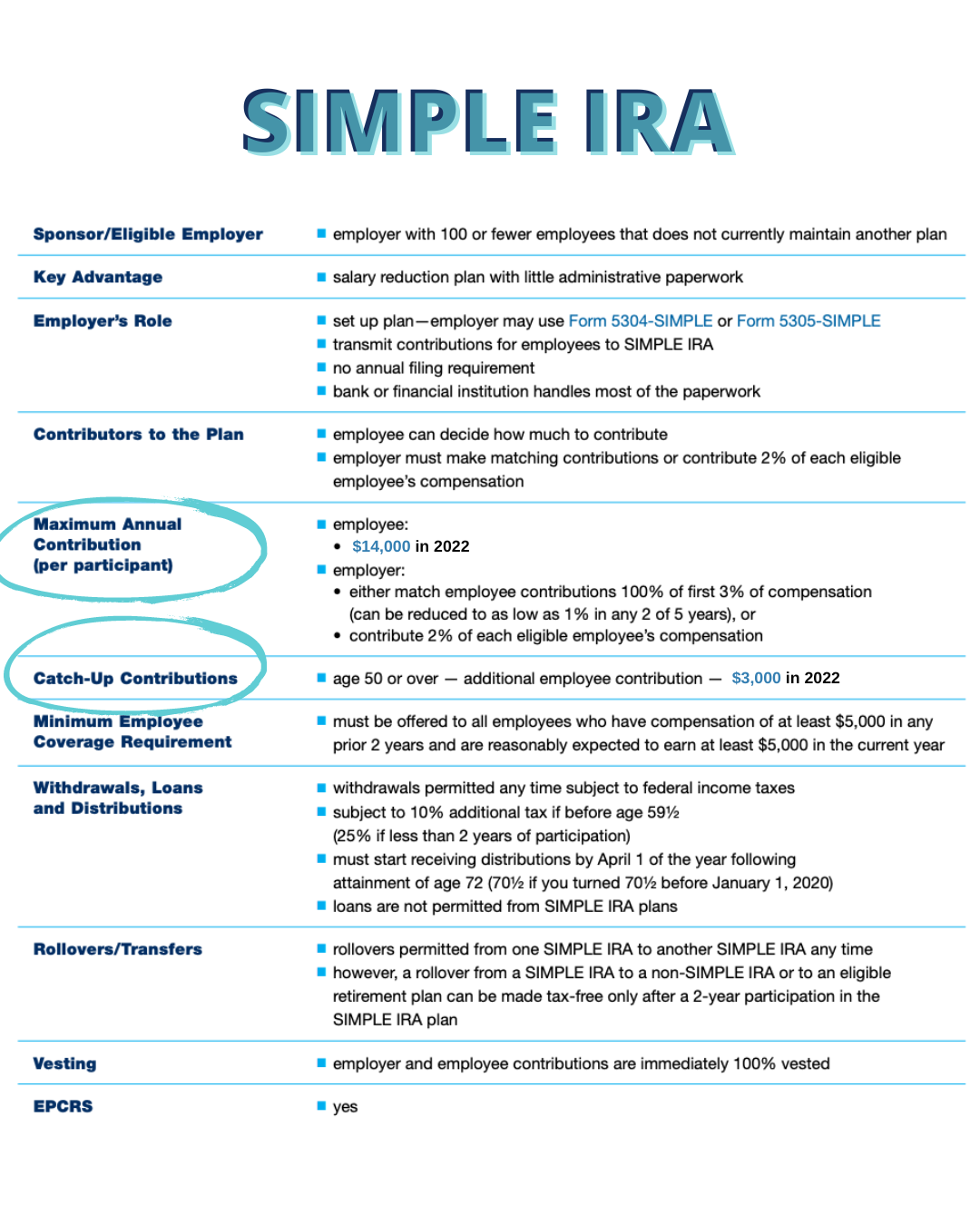

According to the IRS, a Savings Incentive Match Plan for Employees (SIMPLE IRA) is ideally suited as a start-up retirement savings plan for small employers, as it allows for retirement deferral and is administratively easier than a 401(k) or 403(b).

According to the IRS, a Savings Incentive Match Plan for Employees (SIMPLE IRA) is ideally suited as a start-up retirement savings plan for small employers, as it allows for retirement deferral and is administratively easier than a 401(k) or 403(b).