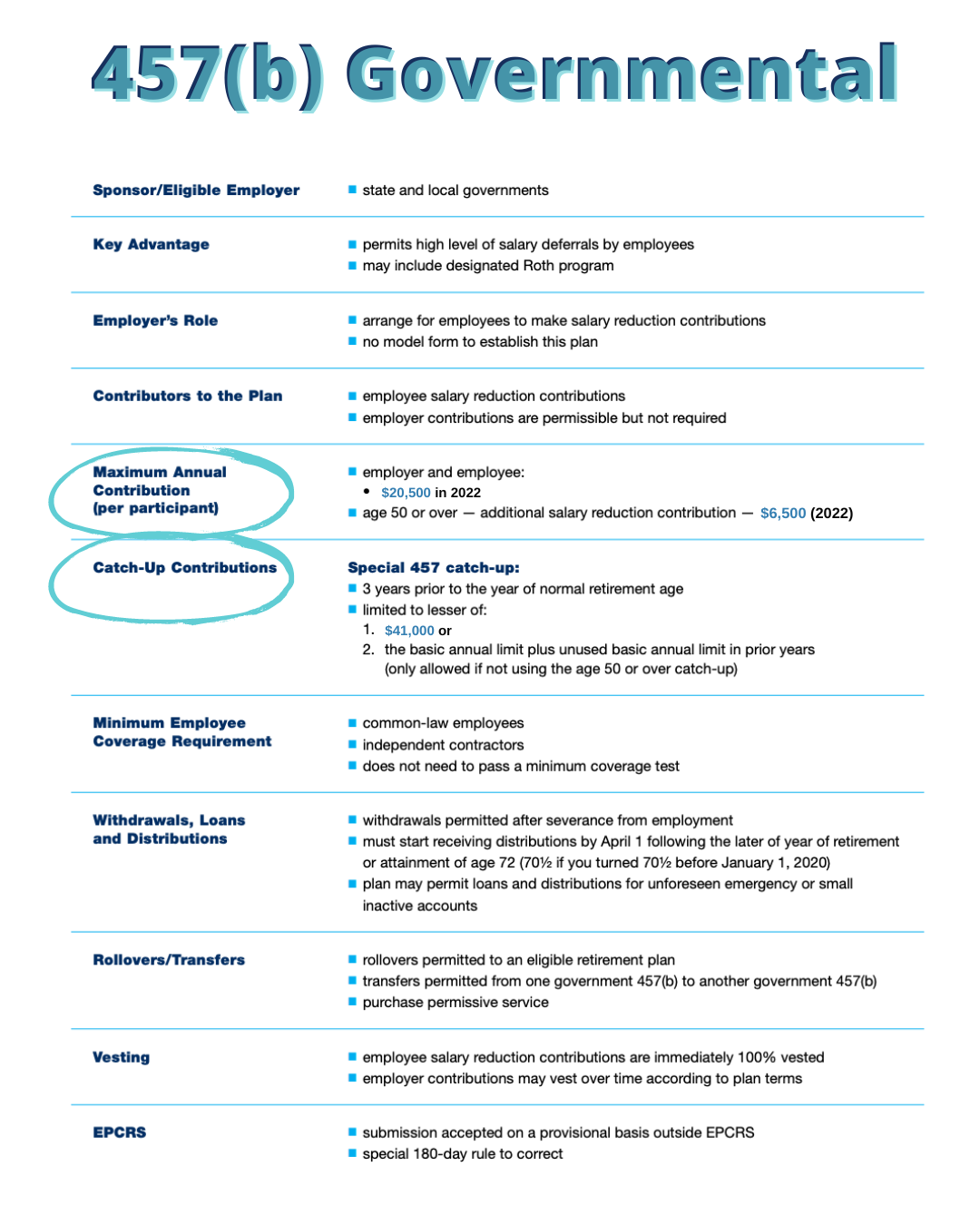

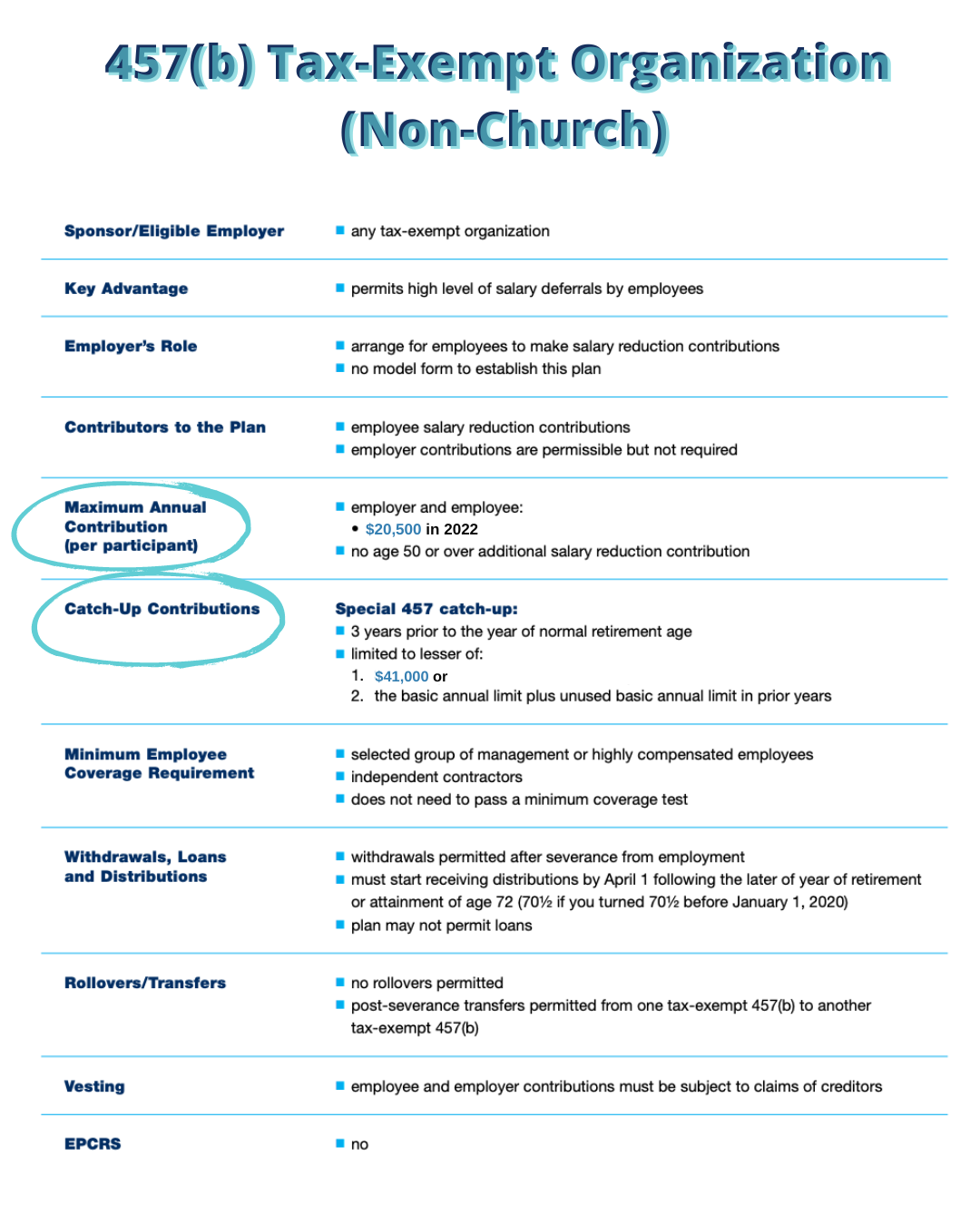

There are two different 457(b) retirement plans: the 457(b) Governmental and the 457(b) Tax-Exempt Organization (Non-Church). 457(b) plans are independent of 403(b) or 401(k) plans; therefore, employees can maximize both plan contribution limits in a single year.

Additional catch-up contributions may also be allowed within 3 years of retirement.