Our Suite of Financial Planning Services

Investment

Management

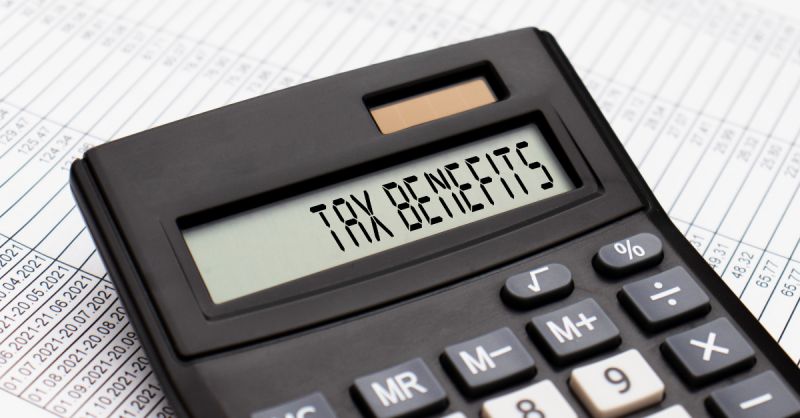

Tax

Planning

Divorce

Planning

Insurance

Planning

Retirement

Planning

Estate

Planning

Our Commitment to You AS TRUSTED FINANCIAL PLANNERS

At WFA Asset Management Corporation, our Milwaukee-based, fee-only investment & retirement advisors are committed to assisting you as you strive to achieve your financial goals. This responsibility is both a commitment and an honor. It defines who we are as a company.

Offering a small-town feel to the “millionaire next door”, our CPAs and CERTIFIED FINANCIAL PLANNERS™ use objective research when providing unbiased advice tailored to your investment and income tax situation as you navigate life-changing events like a new job, an expanding family, retirement, or receipt of an inheritance. By helping you navigate these life obstacles as well as standard market volatility so you can live a happy, comfortable life, you will also create a financial legacy for your loved ones.

Asset Management For You And The Generations To Come

Our team is always working diligently to ensure our clients receive the best possible advice for their individual situation, whether it’s diversifying a portfolio or helping younger generations manage inherited wealth. We maintain our commitment further through continuing education, both ours and yours through:

- Regular communication that interprets changes in economic metrics/markets

- Comprehensively analyzing regulatory matters so you can understand how new legislation affects your investments and financial goals

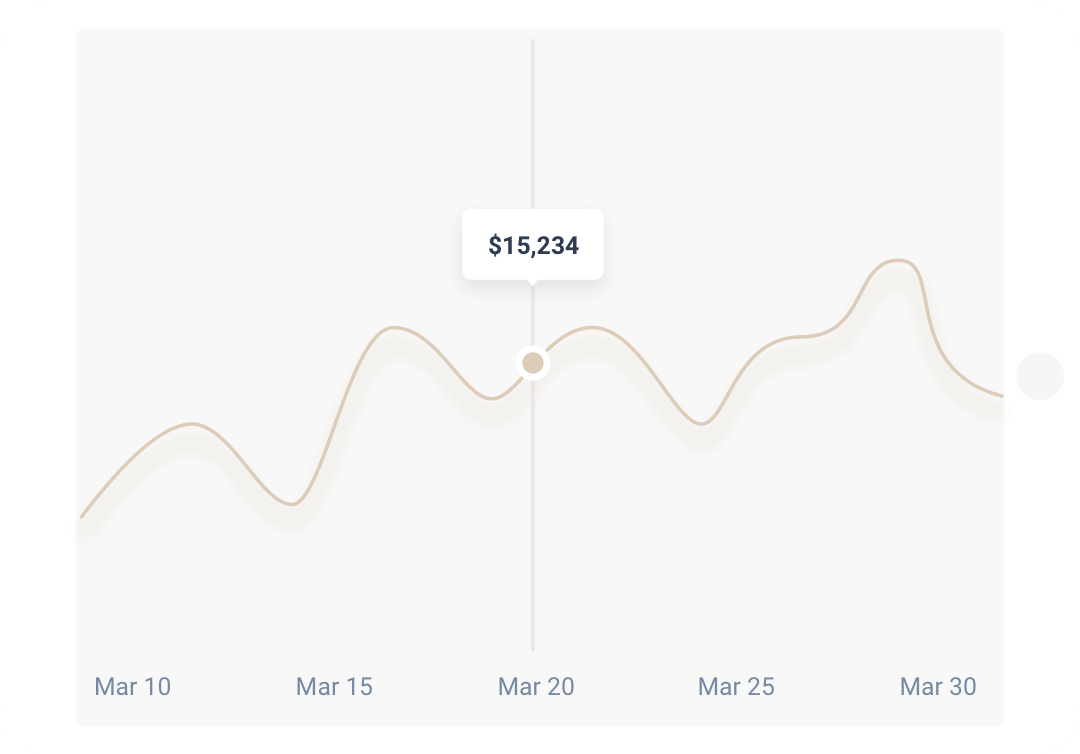

- Enhanced service offerings that incorporate online tools to provide 24/7 access to portfolio activity

- Consolidating account information so you can better understand both big picture and granular metrics

We will help you weather the storm

The Secure Act Changed Distribution Rules

On December 23, 2022, President Biden signed the SECURE 2.0 Act of 2022, which will restructure most Americans’ 401(k) plans and change retirement contributions and withdrawals.

Financial Freedom is Possible

For nearly 40 years, WFA has helped clients get control of their financial situation and feel empowered to make sound decisions when confronted with life’s challenges. Learn from our knowledge and expertise as you continue your journey towards financial independence.